how much taxes are taken out of paycheck in michigan

The percentage of taxes taken out of a paycheck depends on the number of exemptions you are allowed to claim. The standard deduction dollar amount is 12550 for single households and 25100 for married couples filing jointly for the tax year 2021.

Taxpayers can choose either itemized deductions or.

. Able to claim exemptions. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. FICA contributions are shared between the employee and the employer.

FICA taxes are commonly called the payroll tax however they dont include all taxes related to payroll. The average amount taken out is 15 or more for. Employees Michigan Withholding Exemption Certificate MI-W4 Sales Use and Withholding Taxes Annual Return 5081 Authorized Representative DeclarationPower of Attorney 151.

GOBankingRates found the total income taxes paid total tax burden and how much was taken out of a bi-weekly paycheck for each state. How is Michigan unemployment tax calculated. It is not a substitute for the advice.

Michigan fiscal year starts from October. Income tax withholding rate. How much tax is taken.

Every Michigan employer who is required to withhold federal income tax under the Internal Revenue Code must be registered for and withhold Michigan income tax. All About Incomes - Questions and Answers. FICA taxes consist of Social Security and Medicare taxes.

62 of each of your. All data was collected on and up. Michigan Hourly Paycheck Calculator.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Michigan residents only. Your tax-free amount doesnt use up any of your Personal Allowance the amount of income you dont have to pay tax on. How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our.

Michigan Salary Paycheck Calculator. The federal Fair Labor Standards Act FLSA and Michigans Payment of Wages and Fringe Benefits Act PWFBA allow employers to take legally authorized and voluntarily agreed upon. The standard Personal Allowance is 12500.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Liability the tax rate is set by Michigan law at 27. How much taxes come out of my paycheck in Michigan.

W4 Employee Withholding Certificate The IRS has changed the withholding rules. Local income tax ranging from 1 to 24. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4.

No state-level payroll tax. How much tax is withheld in Michigan. The income tax is a flat rate of 425.

27 rows In Michigan all forms of compensation except for qualifying pension and retirement payments are.

U S Senator Debbie Stabenow Of Michigan

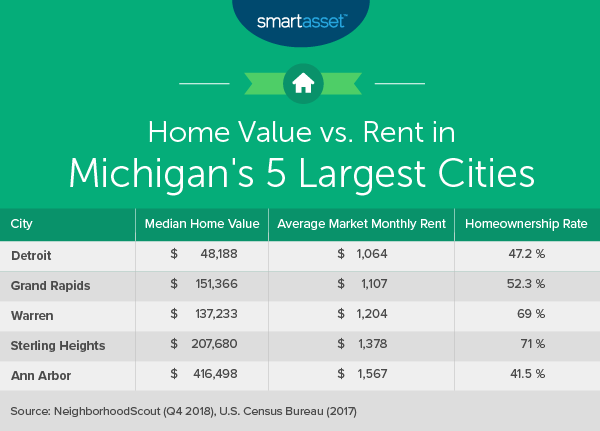

Michigan Income Tax Calculator Smartasset

Many People Live Paycheck To Paycheck And Missing Any Time Because Of A Workplace Accident Can Result In A Financial Dis Paying Taxes Worker Workplace Accident

Key Takeaways From New Mi Flow Through Entity Tax Guidance

Gov Gretchen Whitmer Seeks Insurance Refund It Could Pay 80 To 700 Per Michigan Driver Bridge Michigan

Treasury Tax Reform A Look Back Since 2011

Michigan State Taxes 2022 Tax Season Forbes Advisor

Michigan Lawmakers Ethics Reform Will Build Public Trust Critics Not Likely Bridge Michigan

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Payroll Services And Regulations Gusto

Get Ready Get Set Get Going Lesson 2 Presentation Mi Money Health

State Of Michigan Taxes H R Block

Michigan Income Tax Calculator Smartasset

Michigan Income Tax Calculator Smartasset

Michigan Sales Tax Calculator Reverse Sales Dremployee